Steps to Submit Borang E / CP8D

As an employer in Malaysia, you are required to submit your company CP8D via LHDN MyTax Portal before 31st March every year. In this guide, we’ll take you through the steps on how to submit your Borang E / CP8D online.

Part 1: How to submit E-Data Praisi / E-CP8D?

Step 1 : Login to LHDN MyTax Portal

-

To get started with your submission, select login via Identification Card No. (Please note that this should be your company director identification number)

-

Once you’ve entered the identification number, click on the Submit button

Step 2 : From the homepage, click on ezHasil Services > e-Data Praisi / e-CP8D to proceed

In case you are unable to submit through e-Data Praisi / e-CP8D or miss the deadline, you have the option of sending the text or Excel file directly to LHDN at cp8d@hasil.gov.my via email.

Step 3 : Enter your Employer Number and check if it’s your company name, click Confirm to proceed

Step 4 : Double check your employer profile and click on submission of CP8D on the left panel

Step 5 : You can directly upload your CP8D from SQL Payroll to save time (Method 1), or you can manually enter the 20+ columns for each employee one by one in the online form (Method 2)

Method 1: Upload CP8D (With SQL Payroll)

Open SQL Payroll, go to Payroll > Government Report > Print Income Tax CP8D

Select the year and click Apply. Then, click on the submission of LHDN’s CP8D via Magnetic Media at the bottom right

Save to desktop. The text file will be exported automatically, and you can upload it directly to LHDN CP8D

Once uploaded, all staff information & figure will be filled up automatically

Method 2: Manual Entry (Without SQL Payroll)

Step 6 : Update employer declaration, click Confirm, and Submit. That’s it!

Step 7 : Once submitted, you will be redirected to a page of acceptance acknowledgement, click on the option to print and confirm, remember to save a copy for your records!

Part 2: How to submit e-Filing?

Once you completed part 1 of the submission process for E-Data Praisi / e-CP8D, then follow these steps to submit your e-filling.

Step 1 : After login, click on ezHasil Services > e-Filing from homepage

Step 2 : Access the e-Form

Step 3 : Select the tax year under e-E

Step 4 : Fill in your company’s income tax number and proceed

Step 5 : Under the “Cara pengemukaan C.P.8D” section, select “Melalui e-Data Praisi / e-CP8D” and click “Seterusnya”

Step 6 : Enter the number of employees for your company and click “Next”

Step 7 : Proceed to the next step, as we have already completed the submission or upload process in e-Data Praisi/e-CP8D (Part 1)

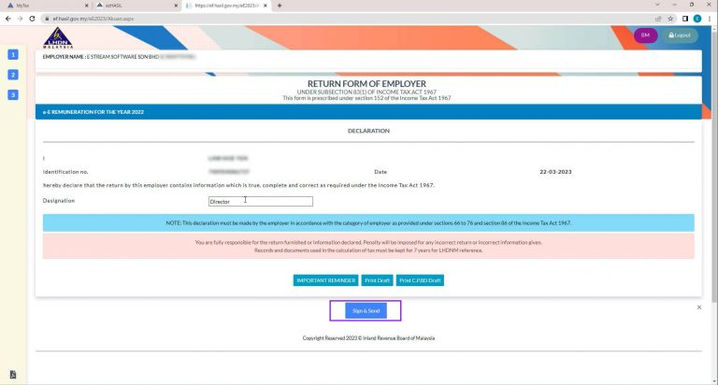

Step 8 : Fill in the designation, sign & send

Step 9 : Enter your identification number and password, sign to proceed

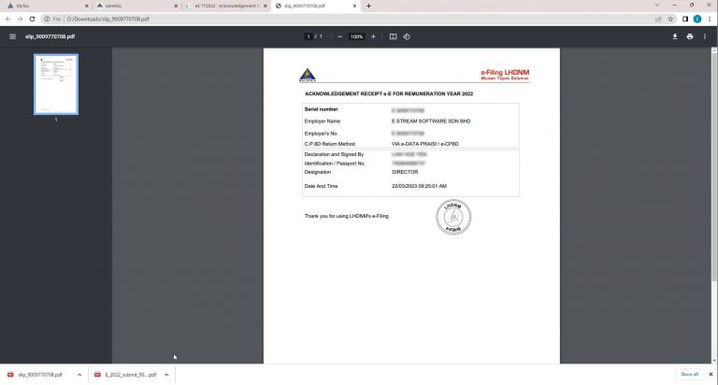

Step 10 : Print the acknowledgement and e-E form to save a copy of your submission

Sample Acknowledgement Receipt for e-E

In conclusion, submitting Borang E / CP8D online in Malaysia can be so easy process with SQL Payroll. Don’t risk manual errors and penalties any longer, start using SQL Payroll to improve your company efficiency & accuracy!

SQL Payroll Software Favoured Features

Certified By Statutory Bodies & 100% Accurate

Compliant with employment requirements in Malaysia. Inclusive of KWSP, SOCSO, LHDN, EIS, HRDF, EPF Borang A, SOCSO Borang 8A, Income Tax CP39, and Borang E ready. SQL Payroll software is ready to use with minimal setup for all companies.

Comprehensive Management Reports

Print payroll summary, yearly payroll individual report, contribution info report & many more.

Electronic Submission & E-Payment Ready

SQL Payroll Software E-submission format are prepared for all banks in Malaysia. Maybank, CIMB, HLBB, Public Bank & many more

Unlimited Year Records

Records salary info for unlimited amount of years & print EA forms for any year

Batch Email Payslip

Securely send payslips to employees using batch email with password encryption

E Leave Mobile App

Apply for leave anytime anywhere with speedy approval from management. Get managerial view of individual leave reports and EA forms

View Gallery

50% MSME Digital Grant

CALLIG ALL MALAYSIAN MSMES !

Take advantage of this limited 50% matching grant up to RM5,000 per entity for subscribing to IRS Alaya New Retail Cloud POS Solution, IRS Retail POS System and

IRS F&B POS System, SQL Cloud, SQL Account, Inventory, Payroll, POS, and more